Real Estate Investing Tips sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

When it comes to navigating the world of real estate investing, having the right tips and strategies at your fingertips can make all the difference.

Introduction to Real Estate Investing

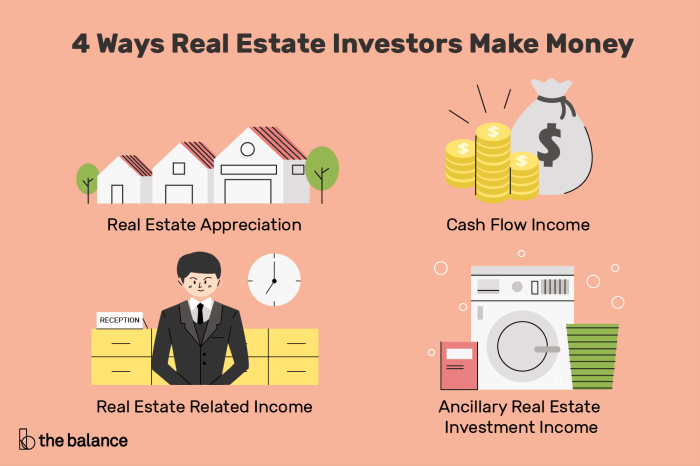

Real estate investing involves purchasing, owning, managing, renting, or selling property for profit. It is a popular form of investment with the potential for high returns and long-term wealth accumulation.

Significance of Real Estate Investing

Investing in real estate offers several benefits that make it an attractive option for many individuals:

- Appreciation: Real estate properties tend to increase in value over time, providing investors with potential capital gains.

- Passive Income: Rental properties can generate regular income through tenant payments, offering a steady cash flow.

- Diversification: Real estate investments can help diversify a portfolio, reducing overall risk exposure.

- Tax Advantages: Investors can benefit from tax deductions, depreciation, and other incentives specific to real estate holdings.

Examples of Successful Real Estate Investors

Many well-known individuals have achieved significant success through real estate investing:

- Donald Trump: The former President of the United States built a real estate empire through strategic property acquisitions and developments.

- Barbara Corcoran: A prominent entrepreneur and television personality, Corcoran established a successful real estate brokerage business.

- Robert Kiyosaki: Best-selling author of “Rich Dad Poor Dad,” Kiyosaki advocates for real estate investing as a path to financial independence.

Types of Real Estate Investments

Residential, commercial, and industrial real estate investments offer different opportunities for investors to diversify their portfolios and generate income.

Residential Real Estate

Residential real estate involves properties like single-family homes, townhouses, and condominiums that are used for living purposes. These investments typically offer steady rental income and long-term appreciation potential.

- Pros:

- Relatively stable demand for rental properties

- Potential for consistent cash flow

- Cons:

- Property maintenance and management responsibilities

- Market fluctuations affecting property values

Commercial Real Estate

Commercial real estate includes properties like office buildings, retail spaces, and warehouses that are used for business purposes. These investments can provide higher rental income but may also come with higher risks.

- Pros:

- Potential for higher rental yields

- Diversification from residential investments

- Cons:

- Market sensitivity to economic conditions

- Longer vacancies between tenants

Industrial Real Estate

Industrial real estate comprises properties like factories, warehouses, and distribution centers used for manufacturing or logistics purposes. These investments can offer stable income streams but require specialized knowledge.

- Pros:

- Long-term leases with established tenants

- Potential for consistent cash flow

- Cons:

- Market dependence on industrial demand

- Higher upfront costs for specialized properties

Factors to Consider Before Investing in Real Estate

When it comes to investing in real estate, there are several key factors that you need to consider to make a wise decision. From location and market trends to property condition and economic factors, each plays a crucial role in determining the success of your investment.

Location

The location of a property is one of the most important factors to consider before investing in real estate. A prime location can significantly impact the value of the property and its potential for appreciation. Factors such as proximity to amenities, schools, transportation, and job opportunities should all be taken into account when evaluating a property’s location.

Market Trends

Understanding market trends is essential for making informed real estate investment decisions. By analyzing factors such as supply and demand, median home prices, and rental rates in the area, you can determine whether it is a good time to invest in a particular market. Keeping up to date with market trends will help you identify opportunities and potential risks in the real estate market.

Property Condition, Real Estate Investing Tips

The condition of a property can greatly affect its value and potential for returns. Before investing, it is crucial to conduct a thorough inspection of the property to identify any issues or repairs that may be needed. Understanding the property’s condition will help you determine the overall investment costs and potential returns.

Economic Factors

Economic factors such as interest rates, employment rates, and GDP growth can have a significant impact on real estate investments. For example, low-interest rates can make financing more affordable, while high employment rates can increase demand for rental properties. By staying informed about economic indicators, you can anticipate how these factors may influence the real estate market and make strategic investment decisions.

Financing Options for Real Estate Investments

When it comes to real estate investing, understanding the various financing options available is crucial. Different financing options come with their own set of advantages and disadvantages, so it’s important to weigh your options carefully before making a decision. Here, we will explore some common financing options for real estate investments and provide tips on securing financing.

Traditional Mortgages

- Traditional mortgages are one of the most common ways to finance real estate investments.

- Advantages include lower interest rates and longer repayment terms.

- Disadvantages may include stricter qualification requirements and longer approval processes.

Hard Money Loans

- Hard money loans are a quicker alternative to traditional mortgages and are based on the value of the property rather than the borrower’s credit.

- Advantages include faster approval and funding times.

- Disadvantages may include higher interest rates and shorter repayment terms.

Private Money Lenders

- Private money lenders are individuals or private companies that provide financing for real estate investments.

- Advantages include more flexible terms and faster approval processes.

- Disadvantages may include higher interest rates and fees.

Tips for Securing Financing

- Improve your credit score to qualify for better financing options.

- Prepare a solid business plan outlining your investment strategy and potential returns.

- Build relationships with lenders and network with other real estate investors to find financing opportunities.

Real Estate Investment Strategies

When it comes to real estate investment, having a solid strategy is crucial for success. Let’s dive into some popular investment strategies and tips on how to build a diversified portfolio tailored to your goals and risk tolerance.

Buy and Hold Strategy

- Buy and hold strategy involves purchasing a property with the intention of holding onto it for the long term.

- This strategy is ideal for investors looking to generate passive income through rental payments and benefit from property appreciation over time.

- Key tip: Choose properties in high-demand areas with strong rental potential for a steady stream of income.

Fix and Flip Strategy

- The fix and flip strategy involves purchasing a property below market value, renovating it, and selling it for a profit.

- This strategy requires a keen eye for undervalued properties and the ability to manage renovations effectively.

- Key tip: Calculate renovation costs accurately and ensure the potential resale value justifies the investment.

Rental Properties Strategy

- Rental properties strategy involves buying properties to rent out and generate monthly rental income.

- Investors can benefit from both rental income and property appreciation over time with this strategy.

- Key tip: Screen tenants carefully to ensure reliable rental payments and maintain the property to attract quality tenants.

Creating a Diversified Portfolio

- Diversification is key to reducing risk in your real estate investment portfolio.

- Consider investing in different types of properties, such as residential, commercial, or vacation rentals, to spread risk.

- Key tip: Allocate your investments based on your risk tolerance and financial goals to create a well-balanced portfolio.

Tailoring Your Strategy to Goals and Risk Tolerance

- Define your investment goals and risk tolerance before developing your real estate investment strategy.

- Consider factors like your timeline, financial situation, and comfort level with risk when choosing the right strategy for you.

- Key tip: Consult with a financial advisor or real estate expert to help tailor your strategy to meet your specific needs and goals.

Risk Management in Real Estate Investing

Real estate investing can be rewarding, but it also comes with its fair share of risks. It’s crucial for investors to understand these risks and have strategies in place to mitigate them in order to protect their investments.

Common Risks Associated with Real Estate Investments

- Market Volatility: Real estate markets can fluctuate, impacting property values and rental income.

- Interest Rate Changes: Increases in interest rates can affect financing costs and property affordability.

- Vacancy Rates: High vacancy rates can lead to income loss and affect cash flow.

- Property Damage: Natural disasters, accidents, or vandalism can damage properties and result in repair costs.

Strategies for Mitigating Risks in Real Estate Investing

- Diversification: Spread investments across different property types and locations to reduce risk exposure.

- Insurance: Obtain comprehensive insurance coverage to protect against property damage or liability claims.

- Reserve Funds: Set aside funds for unexpected expenses like maintenance, repairs, or periods of vacancy.

- Thorough Due Diligence: Conduct thorough research and analysis before investing in any property to minimize risks.

Tips on Creating Contingency Plans for Unexpected Situations in Real Estate Investments

- Emergency Fund: Establish an emergency fund to cover unexpected expenses or income disruptions.

- Legal Counsel: Consult with legal professionals to ensure contracts and agreements protect your interests.

- Regular Inspections: Conduct regular property inspections to identify and address issues before they escalate.

- Communication: Maintain open communication with tenants, contractors, and property managers to address issues promptly.

Real Estate Market Analysis: Real Estate Investing Tips

Before diving into a real estate investment, it is crucial to analyze market trends to make informed decisions.

Importance of Real Estate Market Analysis

Conducting a thorough market analysis helps investors understand the current state of the real estate market, identify potential risks and opportunities, and predict future trends.

- Assess supply and demand dynamics in the market.

- Evaluate local economic indicators and employment trends.

- Study demographic shifts and population growth in the area.

- Monitor interest rates and financing options available.

Tools and Resources for Market Analysis

There are various tools and resources available to help investors conduct a comprehensive market analysis:

- Real estate websites like Zillow, Redfin, and Realtor.com for property listings and market data.

- Local government websites for information on zoning regulations and development plans.

- Market research reports and publications from reputable sources.

- Networking with real estate professionals and attending industry events for insights.

Interpreting Market Data

Interpreting market data accurately is essential for making informed investment decisions:

- Look for trends in property prices, rental rates, and vacancy rates.

- Compare market data with historical performance to identify patterns.

- Consider the impact of economic factors and external influences on the market.

- Consult with local experts and professionals for guidance on market conditions.

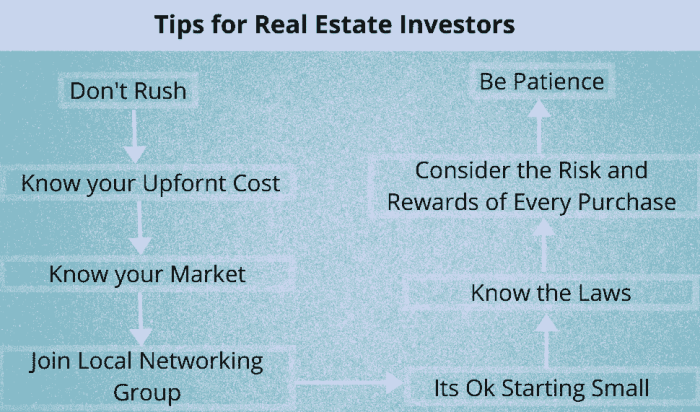

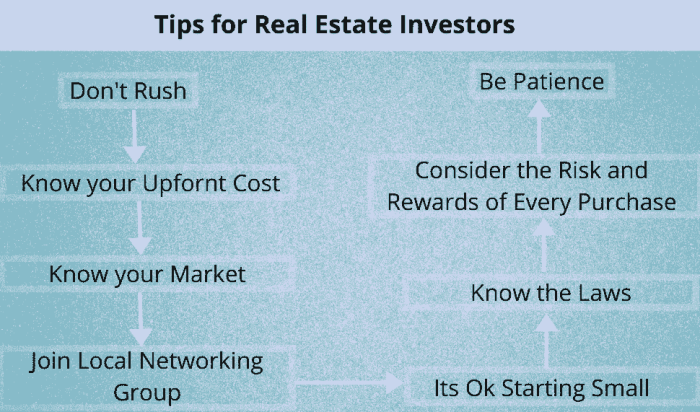

Real Estate Investment Mistakes to Avoid

When starting out in real estate investing, it’s crucial to be aware of common pitfalls that many beginners fall into. By learning from others’ mistakes, you can navigate the industry more effectively and increase your chances of success.

Lack of Research and Due Diligence

One of the biggest mistakes novice real estate investors make is diving into a deal without conducting thorough research and due diligence. This can lead to unexpected expenses, legal issues, or buying a property in a declining market.

Overleveraging

Using too much leverage, or borrowing beyond your means, can backfire if the market turns or rental income doesn’t cover mortgage payments. It’s important to strike a balance and not stretch yourself too thin financially.

Ignoring Market Trends

Not keeping up with real estate market trends and failing to adapt to changing conditions can result in missed opportunities or investing in the wrong type of property. Stay informed and be flexible in your investment approach.

Underestimating Expenses

New investors often underestimate the costs associated with owning and maintaining a property. From repairs and maintenance to property management fees, it’s essential to factor in all expenses to accurately assess the profitability of an investment.

Rushing into Deals

Feeling pressured to close a deal quickly can lead to impulsive decisions and overlooking red flags. Take your time to evaluate potential investments thoroughly and don’t be afraid to walk away if the numbers don’t add up.

Not Seeking Professional Advice

Attempting to navigate the complex world of real estate investing without seeking guidance from experienced professionals can be a costly mistake. Working with real estate agents, attorneys, and financial advisors can provide valuable insights and help you avoid potential pitfalls.